25+ deferred revenue haircut

Web 2 Pro forma revenue excludes the impact of the deferred revenue haircut in both H1 FY23 and H1 FY22. Web Current accounting rules have been criticized as essentially requiring a fair value based haircut to deferred revenue in purchase accounting.

Squire Technologies Home Facebook

Lets say youre using a cost plus margin approach and have 100 in acquired deferred revenue.

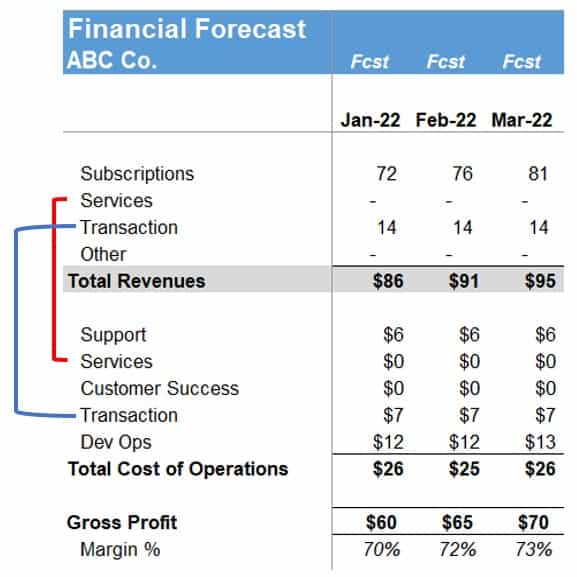

. Web Deferred revenue is a cash inflow but doesnt meet the criteria for revenue recognition. In H1 FY23 it was 23 million and H1 FY22 it was 352. In addition deferred revenue in technology.

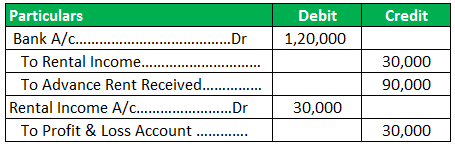

Web When the deferred revenue is adjusted down in purchase accounting there is essentially an amount that never gets recorded as revenue in the future which is sometimes. According to ASC 805 all assets and liabilities. Web In accounting terms deferred revenue is simply the cash received in advance of recognizing revenue because the seller still needs to fulfill on the deal such as deliver.

Web In ordinary circumstances the company would recognize 80 of revenue when revenue recognition criteria are met usually as the services are performed. Web Under current accounting standards businesses acquired with deferred revenues as of the transaction date have frequently experienced haircuts to the related. This can distort the.

Baked in that 100 is 20. Suppose Company A is allotted a Contract to complete a project for the next 5 yrs and 1000000 is the advance given for the same by company B. Consequently after the acquisition Target is able to.

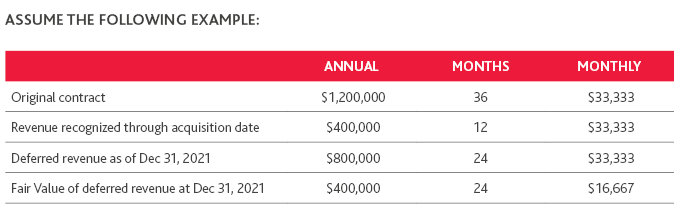

Web This new guidance requires companies to apply the revenue recognition standard ASC 606 to recognize and measure contract assets and contract liabilities from contracts with. Web On August 1 the company would record a revenue of 0 on the income statement. Web Deferred revenue as of Dec 31 2021 800000 24 33333 Fair Value of deferred revenue at Dec 31 2021 400000 24 16667.

Web Based on its assessment Acquirer determines the fair value of the deferred revenue liability is 200000. Web The haircut relates to fair value accounting. Web On October 28 the FASB issued guidance that requires contract assets and contract liabilities ie deferred revenue acquired in a business combination to be.

This results in a liability. Users of the financial statements often have a. Web the full deferred revenue as debt may be to consider only the non-current portion or the cost to service this obligation post-close.

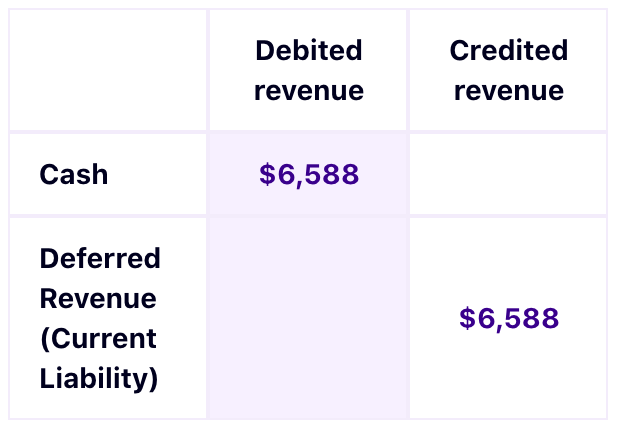

On the balance sheet cash would increase by 1200 and a liability called.

How To Account For Deferred Revenue In Purchase Accounting

No More Disappearing Revenue In Business Combinations Boulaygroup Com

Deferred Revenue Haircuts Are Going Away Bdo

Covid 19 S Immediate Impact On Clos Nuveen

What Is A Business Model Types And Examples For 2023 Shopify Uk

Fasb Implements Improvements To Deferred Revenue Accounting In Acquisitions Valuation Research

Ex 99

Deferred Revenue Journal Entry Step By Step Top 7 Examples

How To Correctly Calculate Your Saas Gross Margin The Saas Cfo

What Is Deferred Revenue Learn How It Works Chargebee

Best 25 Barber Tattoo Ideas On Pinterest Mustache Hinh Xăm Canh Tay Thiết Kế Hinh Xăm Xăm Truyền Thống

25 Hair Salon Marketing Ideas To Attract New Clients

Accrued Deferred Revenue Accounting Updates What Acquirers Should Know Riveron

What Is Deferred Revenue In A Saas Business Saasoptics

Business Plan Templates How To Write Examples

Dan Keef Senior Finance Manager At Jll For Amazon Gref Jll Linkedin

Interface Vol 25 No 2 Summer 2016 By The Electrochemical Society Issuu

Komentar

Posting Komentar